School Lunches

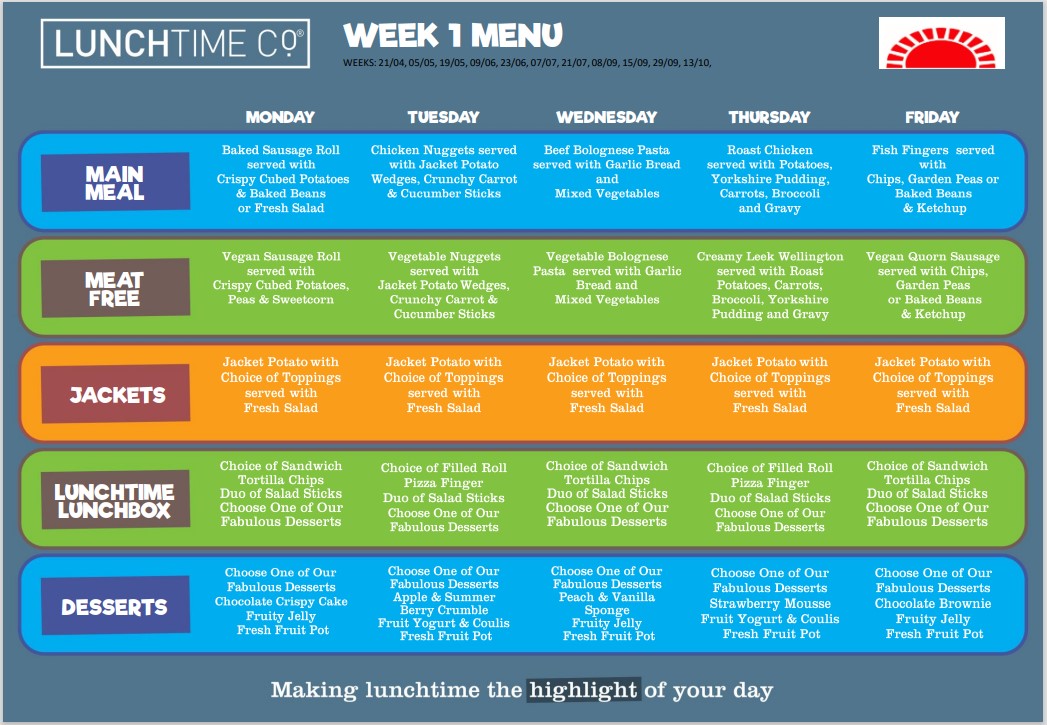

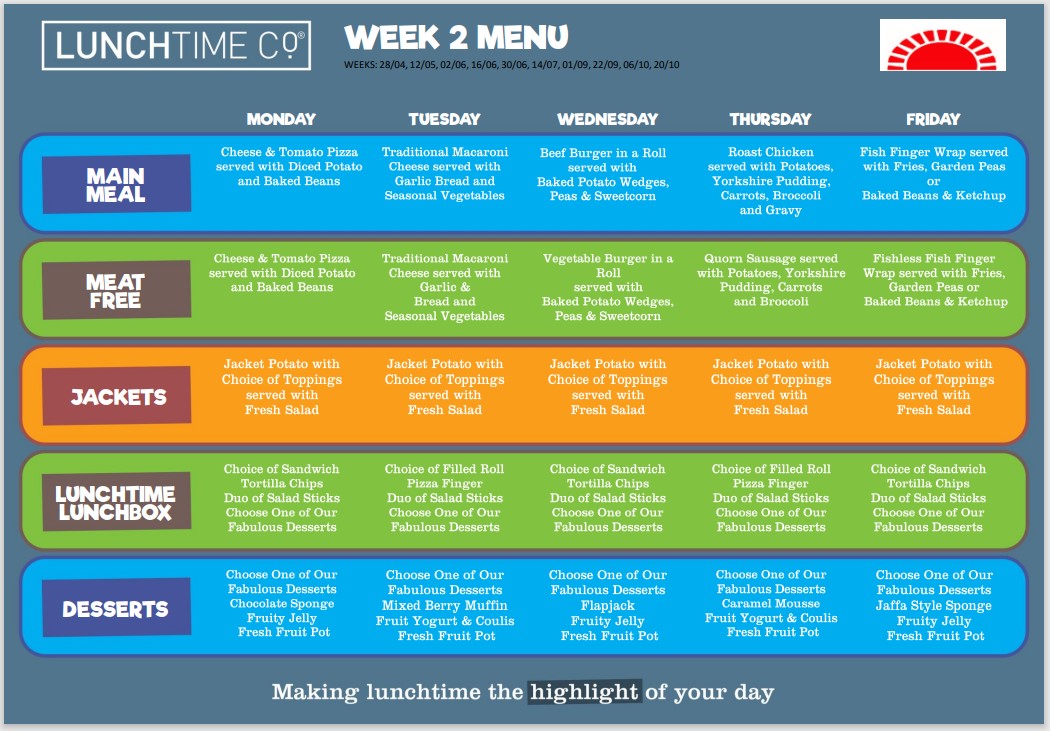

Spring Menu from 21st April 2025

Our Supplier - Lunchtime Co

(from 17th April 2023)

All of our school meals are provided by Lunchtime Co. As the leading provider of catering services to schools across the UK Lunchtime Co believe school lunches should be freshly prepared, great-tasting and attractively presented to engage pupils.

Food is at the heart of everything they do.

It starts with quality ingredients that include Red Tractor Meat, Free Range Eggs & MSC sourced Fish that is prepared and cooked by people who love what they do.

All the food is freshly cooked with ingredients from trusted suppliers.

Pupils and parents can be assured that they are serving great quality food that will help them grow and learn.

Lunchtime Co work closely with our schools and are committed to creating long term relationships. They have a genuinely flexible approach to everything from individually created menus, to service style and added value initiatives such as cookery clubs, food demonstrations and curriculum-based theme days.

As part of the Universal Free School Meals initiative ALL children at Springfield Infants are entitled to a FREE, tasty, nutritionally balanced hot meal at lunchtime and it is our expectation that all children will take up this offer.

Currently almost 90% of our children have a free meal every day - see what they are enjoying eating by clicking on the current menu below. Children have the option each day of choosing either a hot meal, a cold lunch from our 'Lunchtime Lunchbox' menu or a jacket potato with a tasty filling.

Free School Meals - why bother registering?

Your child will be able to get free school meals when they attend the Junior School and will attract Pupil Premium if you receive any of the following benefits:

- Income Support

- Income based Job Seeker’s Allowance

- Income related Employment and Support Allowance

- Guarantee element of State Pension Credit

- Child Tax Credit, as long as you do not get a Working Tax Credit and have an annual income (as assessed by HM Revenues & Customs) that does not exceed £16,190

- If you are supported under Part IV of the Immigration and Asylum Act 1999

- Working Tax Credit during the four-week period immediately after your employment finishes or after you start to work less hours per week.

To check if your child is eligible, simply call us on 01473 260989.